How To Install Patio Screen Door: Learn How to Install a Sliding Patio Screen Door Today!

Welcome to the ultimate guide on installing a patio screen door. As an expert in this field, I’ll walk you through each step and share valuable insights from my firsthand experience. Let’s dive in and discover the practicality and immense value that a patio screen door adds to your home.

Seamlessly connect indoor and outdoor spaces with ease. The sliding mechanism of a patio screen door creates a harmonious flow between your living areas, allowing you to enjoy nature without compromising comfort or safety.

Say goodbye to pesky insects while still enjoying refreshing breezes. A patio screen door’s retractable mesh acts as an impenetrable barrier, keeping bugs at bay while allowing cool air to circulate freely throughout your home. Investing in a high-quality patio screen door not only benefits your daily life but also boosts your property’s value for potential buyers down the line.

Materials Needed for Patio Screen Door Installation

When it comes to installing a patio screen door, the right materials are crucial. Here’s what you need:

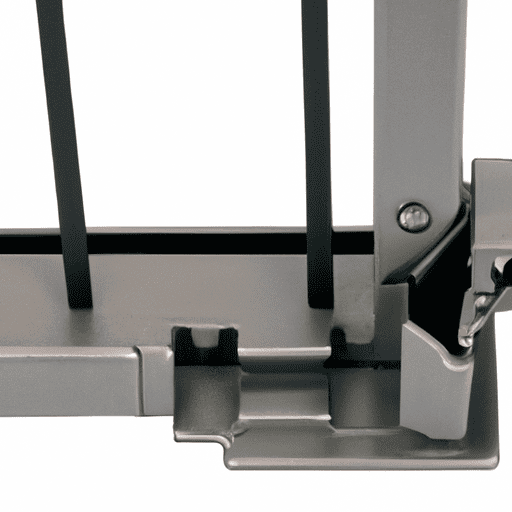

- Patio screen door kit: This all-inclusive kit guarantees an effortless assembly and installation process. It features a sturdy frame, smooth rollers, a convenient handle, and durable mesh.

- Screwdriver: A reliable screwdriver is essential for securely attaching components of your new screen door together and fastening it onto your existing door frame.

- Measuring tape: Accurate measurements are vital when fitting a patio screen door into your doorway. With a measuring tape in hand, you can ensure the perfect fit.

- Drill: Depending on whether you choose a retractable or fixed patio screen door, using a drill may be necessary to create holes for screws or other fasteners during installation.

Step-by-Step Guide to Installing Your Patio Screen Door

With our comprehensive guide, you’ll breeze through the installation process flawlessly. Start by measuring your door frame precisely for a perfect fit.

Then, assemble your screen door effortlessly using the convenient kit provided. Tighten all screws securely for added durability. Position your assembled screen door in front of the doorway and ensure proper alignment with the frame.

Use a screwdriver or drill to firmly secure it in place with pre-drilled holes on each side. Now comes the exciting part! Test out your newly installed patio screen door along its smooth track system for optimal functionality without any obstructions or resistance.

With these expert steps, you can confidently install your own patio screen door like a skilled professional – no need to hire outside help! Enjoy bug-free evenings and refreshing breezes flowing freely into your home’s enhanced outdoor experience. If you encounter any challenges during installation or have questions along the way, consult professional assistance or refer back to manufacturer-provided instructions tailored specifically to their product’s features and maintenance requirements.

- Crafting a Dream Patio with Pavers - November 26, 2023

- DIY Patio Paver Construction - November 24, 2023

- Creating Stunning Patios with Pavers - November 21, 2023